For decades, America lost factories and jobs to China but retained a coveted title: the world’s leader in inventing and commercializing new products.

Now, even that status has been eroded, and it’s hurting the economy.

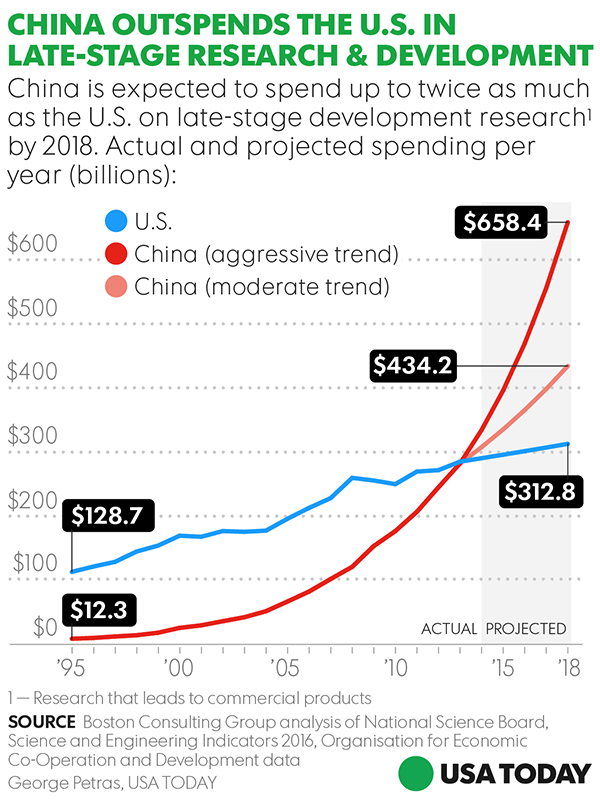

While the United States is still at the top in total investment in research and development — spending $500 billion in 2015 — a new Boston Consulting Group (BCG) study released Monday has made a startling finding: A couple of years ago, China quietly surpassed the U.S. in spending on the later stage of R&D that turns discoveries into commercial products. And at its current rate of spending, China will invest up to twice as much as the U.S., or $658 billion, by 2018 on this critical late-stage research.

In other words, the U.S. Is doing the hard work of inventing new technologies, and China, among other countries, is reaping the benefits by taking those ideas and turning them into commercial products,the report says.

“Other countries are free-riding on the U.S. investment,” says Justin Rose, who co-authored the BCG study.

The slippage is a significant blow for the U.S. economy, costing the country tens of billions of dollars a year in manufacturing output and hundreds of thousands of factory jobs over the past decade or so, BCG says. Companies that lead in commercializing ideas also typically build factories near their research centers so scientists can test products before making them.

The burgeoning commercial drone market is a prime example of the shift. The U.S. military developed drone technology throughout the 20th Century for reconnaissance and other purposes, adding microchips for better wireless control and longer-lasting batteries. But China’s Da-Jiang Innovations has refined the unmanned vehicles to better avoid obstacles and has become the world’s largest builder of commercial drones. It sells them to U.S. real estate and construction firms for applications such as aerial photography and mapping. DJI has three factories in Shenzhen.

The U.S. has also given birth to a Smithsonian-worthy collection of breakthrough technologies — including flat-panel displays, digital mobile handsets, notebook computers and solar panels — only to fumble away their development to other countries, particularly China and Japan.

The BCG study concludes the U.S. has the potential to reverse the trend through better collaboration among private industry, universities and research consortia. Such a shift would increase annual manufacturing output by 5%, or $100 billion, and add 700,000 factory jobs and another 1.9 million in other sectors through ripple effects.

Yet while President Trump is focused on narrowing the nation’s trade deficit, his proposed budget would slash federal funding for R&D, potentially snuffing out a significant source of U.S. manufacturing jobs that could help accomplish that goal. Last year, the U.S. had an $83 billion trade gap in advanced technology products, according to the Census Bureau.

The country is still the global leader in “basic and applied” R&D, which makes early discoveries and further refines them. About a third of the $500 billion the country spends on R&D is funneled to those activities. But while two-thirds of the total goes to later-stage “development” R&D, China invests 84% of its R&D money on advances that yield commercial products. For the past decade, “development” R&D has been growing 20% a year in China, versus 5% in the U.S., the BCG report says. As recently as 2004, the U.S. spent four times as much as China.

In China, many technology companies are state-owned and so they don’t have to worry if massive R&D spending yields losses until a product is commercialized, and even the research of private firms is often subsidized by the government, says Robert Atkinson, president of the Information Technology and Innovation Foundation. The Chinese government, he says, also gives the private sector specific timetables for achieving dominance in areas such as solar, printers, robots and drones. And China routinely steals technology and fails to enforce patent laws, Atkinson says

“They have huge advantages,” he says.

There’s ample opportunity for a U.S. turnaround, BCG says, with 75 of the world’s 200 highest-rated universities located in the U.S. But there’s little cooperation among the schools, which do the lion’s share of basic and applied research, largely through federal grants, and private companies, which do most of the development research.

The Study:

Among the obstacles BCG identified:

• Schools do a poor job of promoting their latest research and putting it in a digestible form for manufacturers. And researchers are focused on securing tenure, while companies are seeking a return on their investment. When companies do partner with universities, it’s often for a limited, product-specific purpose rather than for developing industry-wide solutions that take longer to bring to fruition but can create many more jobs.

“Companies are being gun-shy and risk-averse and not wanting to make big bets on transformative technology,” Atkinson says. Instead, the’re focused on quarterly profits, which typically determine executives’ bonuses.

• U.S. manufacturers are reluctant to collaborate with other companies because they don’t want to share the fruits of their research with competitors.

• Manufacturers are reluctant to work with suppliers to establish industry-wide standards that can reduce costs and speed implementation of technologies, fearing the suppliers would share the information with competitors.

The study says the government should set up a central repository for federally-funded university research; school research should be geared toward commercializing products; manufacturers should build long-term relationships with universities, such as Procter & Gamble’s link-up with the University of Cincinnati; and public-private research consortia should focus on developing industry-wide solutions. Since 2008, P&G has invested millions of dollars in a university computer simulation center to enhance its consumer household products, their packaging and manufacturing processes.

“If we want to be the leader in product development for things that matter in people’s lives, pushing money into developing important (products) is what we should be focused on,” BCG’s Rose says.

Source :usatoday